The latest Chinese activity data was something of a ‘mixed bag’, with continued weakness in consumption emphasising the need for greater fiscal and monetary support to ensure a sustainable economic recovery.

Retail sales, in April, rose 2.3% YoY, a noticeable drop from the 3.1% pace notched a month prior, and considerably below consensus expectations for a 3.7% YoY increase. The monthly data also provided little cause for optimism, with sales – as near as makes no difference – stagnating on an MoM basis.

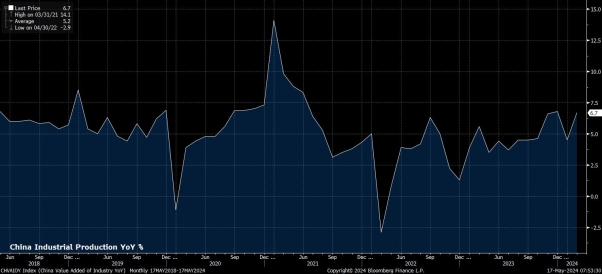

In contrast, the industrial production figures do paint something of a brighter picture. On a YoY basis, production rose 7.7% in April, a significant quickening from the 4.5% pace seen in March, and a substantial upside surprise compared to the 5.5% consensus.

Furthermore, on an MoM basis, production rose just under 1% last month, the fastest pace in more than three years, providing further evidence of the relative resilience of the domestic manufacturing sector.

Taken together, the retail sales and industrial production figures provide further evidence, and reinforcement, of the ‘K-shaped’ economic recovery that China is currently undergoing, particularly when one also takes into account the 1.5% YoY export growth seen last month, underscoring that international demand for Chinese goods remains relatively solid.

Naturally, this demand continues to underpin growth in the manufacturing sector, which has largely fuelled the Chinese economy at large this year.

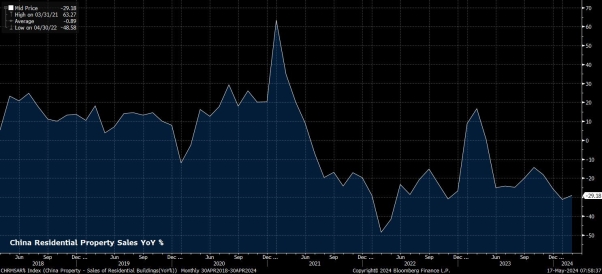

In contrast, a litany of domestic issues, including the prolonged and protracted property crisis, continues to weigh on consumer sentiment, and spending, with data out earlier this week having shown credit falling for the first time in almost two decades. While reports indicate that measures to prop up the property sector are under consideration, including plans for local governments to purchase unsold homes from embattled developers, this feels rather like an attempt to paper over the cracks.

In addition, Chinese authorities have been attempting to turn the sector around for at least three years, to no avail, since the debt crisis began in mid-2021. On top of this, the significant detrimental impacts of such a forced buying policy on local government balance sheets must be taken into account, particularly with overall local government debt sitting north of $9tln, posing a substantial risk to broader financial stability.

Nevertheless, the strong desire to support the property sector underscores how pivotal a more stable real estate environment is in shoring up both consumer confidence, and consumption – a shoring up that, clearly, given today’s figures, is much-needed, in order to unlock the next leg of economic recovery, with manufacturing only able to support a sustainable recovery to a relatively limited degree.

Such a sustainable recovery is likely to be required in order to provide a more solid bull case for Chinese equities, even if the benchmark A50 index has recovered over 20% from the mid-January lows.

This is particularly true given the long-standing, and justified, concern among international investors over the uninvestable nature of China, especially when other regional options for Asia equity exposure – such as India and Japan – appear increasingly favourable.

The Japanese market is one where the bull case is particularly solid, with ongoing corporate reforms aimed at improving company profitability, and increasing cash returns to shareholders, coupled with continued weakness in the JPY, likely to fuel inflows, and equity upside, for some considerable time.